As the holiday season approaches, doctors often give gifts to colleagues, administrative staff, nurses, and...

The Self-Employed Physician

You May Also Like…

How to Organize Yourself for Personal Tax Filing

Step 1: Be Aware of Your Income & Expenses

As a self-employed physician, fee-for-service income can come from a variety of sources, including various health authorities (WRHA, NRHA, IERHA, etc.), private billings, and government agencies. As such, tracking the various income streams be challenging, depending on your time and organization skills.

Some agencies will report fee-for-service income on a T4A slip. This slip is like a T4, except it reports income where no tax was withheld. Other fee-for-service sources, such as clinics, may handle billings on your behalf and prepare reports to summarize billings, collections, and overhead. While these reports are of helpful come tax time, it is unlikely that all of your income sources will provide you with income summaries/slips. This means that you may need to take a more active role in tracking your fee-for-service income.

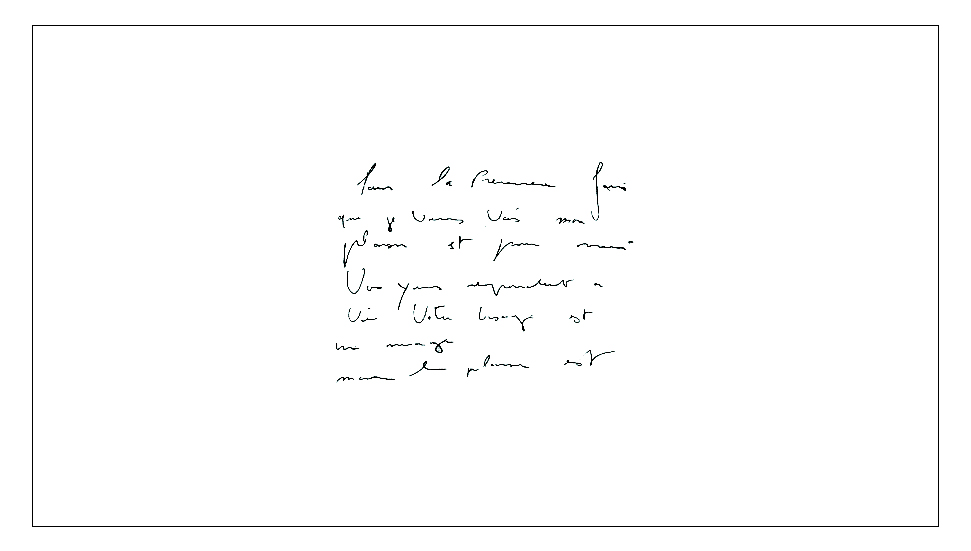

If your writing resembles this, try tracking via excel:

You may wish to employ a billing service provider or submit and track your billings personally. Regardless of the reports available to you, or the method of billings/collections, it is important to keep track of total gross income (inclusive of billings earned but not yet collected) and any administrative fees incurred.

If you have numerous sources of fee-for-service income, it may be beneficial to set up a separate bank account to be used for these deposits and related business expenses. Doing so is advisable as it clearly distinguishes business transactions from personal transactions. This also provides separate business documentation that you can provide your accountant) in order to protect your privacy. Its none of your accountant’s business that you spent $234.04 on McDonalds in just 3 months. It’s been a long winter.

In addition to keeping track of your fee-for-service income, you are also responsible for tracking your business expenses in order to claim them. Generally, you are able to claim any reasonable business expense which had been incurred to earn business income.

In order to substantiate your reasonable business deductions, you will also need to maintain the records for each expense that has been claimed. Typically, records consist of receipts which identify the seller, date of purchase, and a description of the items/services purchased.

Step 2: Record Keeping

Your tax records need to be maintained for a period of 6 years from the end of the calendar year to which they relate.

Records for your income and expenses can be stored in the following formats:

- Paper: Storing physical copies of documents is an acceptable format. However, consideration should be given to the environment in which paper documents are stored so as to avoid possible deterioration or damage.

- Electronic: Electronic records are also acceptable as long as the information is clear and all of the transaction details are present in the electronic copy. It would be best to keep a backup copy to hedge against possible file corruption, or loss of another nature.

Ultimately, there is no superior method for the organization of your medical practice’s tax records. Whether you use an excel tracking log, sort documentation in a physical folder according to type of expense/transaction, or employ a third party to store and organize your files, the completeness of your tax reporting will depend on the type of information you include. The goal is not a colour coded binder that gets delivered to your accountant’s door every March 15th, wrapped in a bow – though we would most certainly appreciate it. The goal is efficient, accurate, and complete tax reporting that makes use of every deduction available to you.

As accountants, we prepare your returns based on the information you provide. Understanding what you should include within your medical practice’s tax records is critical to minimizing tax and optimizing results.

Happy tax season! 😊

You May Also Like…

Tax Implications of Gift Gifting From Your Medical Practice

As the holiday season approaches, doctors often give gifts to colleagues, administrative staff, nurses, and professional advisors. While these gestures are generous, they may lead to unexpected tax implications. Gifts to Non-Employees: Doctors may give gifts to...

11 Reasons Why Physicians Contribute to RESPs

As veterans of higher education, physicians often anticipate that their children will carry the torch of post-secondary learning. Physicians can optimize savings and tax on this future expenditure by contributing to a Registered Education Savings Plan (RESP), which...

Physician New to Canada? What you need to know about Canadian Personal Taxes.

Are you a physician that moved to Canada in the last year? If so, these are some things that you should know about filing your first Canadian Personal Tax Return: When are Canadian taxes due? Canadian personal taxes are calculated based on income earned between...

Basic Overview of Canadian Personal Taxes

Personal tax season is upon us and as you gather your personal tax documents you may be wondering “How are my personal taxes calculated?”. How are Canadian Personal Taxes Calculated? Canadian taxes are based on a graduated rate system. This system can be thought of in...

I Just Called to Scam You

How to determine if it’s CRA on the line. Over the past few years, scam phone calls from individuals claiming to be from the Canada Revenue Agency (CRA) have increased. As we approach the time of year to file personal tax returns, these calls become more frequent as...

RRSP or TFSA

RRSPs and TFSAs are both “registered” investment accounts, which means that they receive special tax treatment that is not applicable to other “non-registered” investment accounts. The special tax treatment of these accounts increases the total benefit of investing by...

Month of Giving (Part 3): Donation of Securities

Instead of liquidating securities to fund donations, it may be more tax efficient to donate securities directly to charitable organizations. If you sell a security to obtain cash to donate, you generally need to pay tax on the profit earned, also known as a capital...

Month of Giving (Part 2): Tax Efficient Donating

Many physicians in Canada have incorporated their practices, as there are significant tax benefits to doing so. This then provides incorporated doctors with two avenues to donation: Corporate Donations Personal Donations We are often asked, “should I make donations...

Month of Giving (Part 1): Donation Tax Credit Refresher

December is the month of giving. While deciding which charitable organizations you wish to support this year, the following donation tax credit information is good to keep in mind: What qualifies as a donation for tax purposes? To qualify for the donation tax...

The Season of Giving – is it taxable?

As the holiday season approaches, it is not unusual for doctors to provide gifts to their employees, hospital administrative staff, colleagues, and nurses. While these gifts are generous gestures, they may result in unexpected tax implications. Gifts to Employees When...