As veterans of higher education, physicians often anticipate that their children will carry the torch of...

The Self-Employed Physician

You May Also Like…

How to Organize Yourself for Personal Tax Filing

Step 1: Be Aware of Your Income & Expenses

As a self-employed physician, fee-for-service income can come from a variety of sources, including various health authorities (WRHA, NRHA, IERHA, etc.), private billings, and government agencies. As such, tracking the various income streams be challenging, depending on your time and organization skills.

Some agencies will report fee-for-service income on a T4A slip. This slip is like a T4, except it reports income where no tax was withheld. Other fee-for-service sources, such as clinics, may handle billings on your behalf and prepare reports to summarize billings, collections, and overhead. While these reports are of helpful come tax time, it is unlikely that all of your income sources will provide you with income summaries/slips. This means that you may need to take a more active role in tracking your fee-for-service income.

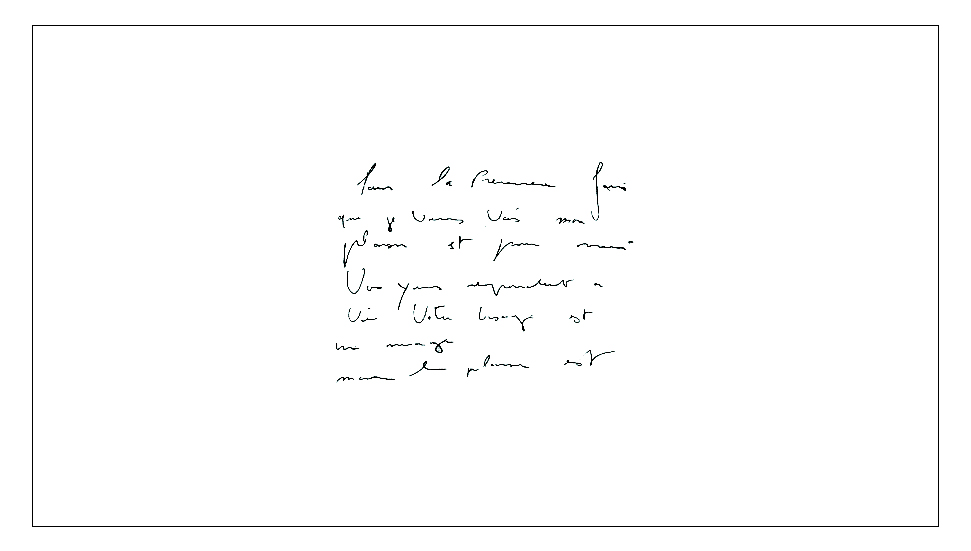

If your writing resembles this, try tracking via excel:

You may wish to employ a billing service provider or submit and track your billings personally. Regardless of the reports available to you, or the method of billings/collections, it is important to keep track of total gross income (inclusive of billings earned but not yet collected) and any administrative fees incurred.

If you have numerous sources of fee-for-service income, it may be beneficial to set up a separate bank account to be used for these deposits and related business expenses. Doing so is advisable as it clearly distinguishes business transactions from personal transactions. This also provides separate business documentation that you can provide your accountant) in order to protect your privacy. Its none of your accountant’s business that you spent $234.04 on McDonalds in just 3 months. It’s been a long winter.

In addition to keeping track of your fee-for-service income, you are also responsible for tracking your business expenses in order to claim them. Generally, you are able to claim any reasonable business expense which had been incurred to earn business income.

In order to substantiate your reasonable business deductions, you will also need to maintain the records for each expense that has been claimed. Typically, records consist of receipts which identify the seller, date of purchase, and a description of the items/services purchased.

Step 2: Record Keeping

Your tax records need to be maintained for a period of 6 years from the end of the calendar year to which they relate.

Records for your income and expenses can be stored in the following formats:

- Paper: Storing physical copies of documents is an acceptable format. However, consideration should be given to the environment in which paper documents are stored so as to avoid possible deterioration or damage.

- Electronic: Electronic records are also acceptable as long as the information is clear and all of the transaction details are present in the electronic copy. It would be best to keep a backup copy to hedge against possible file corruption, or loss of another nature.

Ultimately, there is no superior method for the organization of your medical practice’s tax records. Whether you use an excel tracking log, sort documentation in a physical folder according to type of expense/transaction, or employ a third party to store and organize your files, the completeness of your tax reporting will depend on the type of information you include. The goal is not a colour coded binder that gets delivered to your accountant’s door every March 15th, wrapped in a bow – though we would most certainly appreciate it. The goal is efficient, accurate, and complete tax reporting that makes use of every deduction available to you.

As accountants, we prepare your returns based on the information you provide. Understanding what you should include within your medical practice’s tax records is critical to minimizing tax and optimizing results.

Happy tax season! 😊

You May Also Like…

Financial Considerations of Buying a Home

There is a lot to think about when you buy your first home. What colour should you paint the living room? What should the extra bedroom be used for? A home office? A gym? Or maybe a nursery? Outside of aspirational objectives, there are many practical matters...

Fall Economic Update 2022 – A 5 Minute Summary of the Relevant Provisions for Physicians

Overall Analysis: New details were scarce in the 2022 Fall Economic Statement; for the most part, the Honorable Chrystia Freeland provided more detail on the 2022 Budget Proposals. In summary, the provisions most relevant for physicians were as follows: PROPOSAL:...

Moving Expenses: When are they deductible for physicians?

Are you a physician who moved in 2022, or are considering a move in 2023? If so, your moving expenses may be deductible for tax purposes. Are you eligible to claim moving expenses? To claim moving expenses, you must meet the following criteria outlined by CRA: One...

First Home Savings Account (FHSA) – Newly Announced Updates to the Program

This article has been updated for the draft legislation proposals from the Department of Finance ‘Design of the Tax-Free First Home Savings Account’ Backgrounder, released August 9, 2022.. On April 7, 2022, the Federal Government released a budget with two new...

4 Common Tax Questions from Manitoba Resident Physicians

The most frequent questions we receive from resident physicians relate to their ability to claim various tax credits and deductions. This is often complicated by their participation in various assistance or rebate programs and the continuing cost of their medical...