As the holiday season approaches, doctors often give gifts to colleagues, administrative staff, nurses, and...

Basic Overview of Canadian Personal Taxes

You May Also Like…

Personal tax season is upon us and as you gather your personal tax documents you may be wondering “How are my personal taxes calculated?”.

How are Canadian Personal Taxes Calculated?

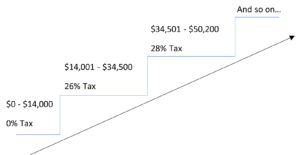

Canadian taxes are based on a graduated rate system.

This system can be thought of in terms of steps, commonly called “tax brackets”. Each bracket represents a range of income that is subject to a specific tax rate. A tax rate is a percentage upon which an individual is taxed.

Income earned within each bracket is taxed at the applicable rate.

The below graphic depicts a simplified version of how this works:

Exhibit A

*Rates and brackets used above are loosely based on the combined Manitoba and Federal personal tax rates, considering the basic personal tax credit, and are not comprehensive. Used for illustrative purposes only.

**Tax rates change annually. The above is based on 2022 tax rates.

Personal taxes are comprised of two parts: federal taxes and provincial taxes.

The federal tax brackets remain the same for every individual, regardless of where they live and work within Canada. The provincial tax brackets vary by province and territory but are still applied using the same graduated rate system.

Exhibit A is based on the combined Manitoba and federal personal tax rates.

Using the above figures, if you earned $40,000 in 2022, your personal tax would be calculated as follows:

$14,000 x 0% = $0

$20,500 ($34,500 – $14,000) x 26% = $5,330

$5,500 ($40,000 – $34,500) x 28% = $1,540

Total tax = $6,870 ($0 + $5,330 + $1,540)

If you had multiple sources of income, the total income received from all sources would be combined and your personal taxes for the year would be calculated based on the total.

Calculating your Taxable Income as a Self-Employed Physician:

If you earn fee-for-service or stipend income (self-employment income), your personal taxes are calculated on your self-employment income less any reasonable business expenses.

Business expenses are considered reasonable if the expense was incurred to earn the fee-for-service income and the costs were not extravagant (for example, CRA would likely not allow a $10,000 hotel expense for a 2-day conference in Banff).

Common examples of reasonable business expenses incurred by self-employed physicians include, but are not limited to:

- CMPA

- Professional dues and memberships – Doctors Manitoba dues, CPSM dues, etc.

- CME costs – This includes registration fees and travel and accommodations if you needed to travel to attend the conference or course.

- Cell phone and internet

If you received a reimbursement for any business expense, the reimbursed portion cannot be claimed. For example, the claim for CMPA insurance or CME should be reduced by any reimbursement received from entities such as Doctors Manitoba.

Calculating your Taxable Income as a Resident Physician:

Resident physicians often have a single main source of income: their wages from the health region in which they work.

As a resident physician, you can expect to receive a T4 slip around February or March that reports the amount of gross wages you received during the prior year.

The gross wages reported on this slip would then be used to calculate your personal income taxes for the year.

If you had also earned fee-for-service income (self-employment income), your personal taxes would be calculated based on the combined total of your gross wages and your self-employment income.

If you received a reimbursement for any of the expenses, the expenses cannot be claimed. So, for example, often the Doctors Manitoba dues are paid for by Shared Health for residents, this is included on your T4 slip and cannot also be claimed against your fee-for-service income. In addition, residents generally only pay for a certain percentage of their annual CMPA fees, and the remainder is covered by PARIM. The claim for the CMPA fees would be limited to the percentage that the resident had to pay.

Can you claim any amounts to reduce your personal taxes?

Yes, in Canada there are several items that can be used to reduce personal taxes, whether you are employed or self-employed.

The following are some of the items that may be claimable on your personal tax return:

- Childcare

- Post-Secondary Tuition

- Donations

- Medical Expenses

- Interest on National or Provincial Student Loans (you cannot claim interest on a Student Line of Credit)

- Contributions made to a Registered Retirement Savings Plan (RRSP)

Receipts for the above items should be kept and provided to your tax preparer each year.

If you are unsure if an item can be claimed on your personal tax return, it is always a good idea to consult a tax professional.

* This article was prepared on February 16, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

You May Also Like…

Tax Implications of Gift Gifting From Your Medical Practice

As the holiday season approaches, doctors often give gifts to colleagues, administrative staff, nurses, and professional advisors. While these gestures are generous, they may lead to unexpected tax implications. Gifts to Non-Employees: Doctors may give gifts to...

11 Reasons Why Physicians Contribute to RESPs

As veterans of higher education, physicians often anticipate that their children will carry the torch of post-secondary learning. Physicians can optimize savings and tax on this future expenditure by contributing to a Registered Education Savings Plan (RESP), which...

Physician New to Canada? What you need to know about Canadian Personal Taxes.

Are you a physician that moved to Canada in the last year? If so, these are some things that you should know about filing your first Canadian Personal Tax Return: When are Canadian taxes due? Canadian personal taxes are calculated based on income earned between...

I Just Called to Scam You

How to determine if it’s CRA on the line. Over the past few years, scam phone calls from individuals claiming to be from the Canada Revenue Agency (CRA) have increased. As we approach the time of year to file personal tax returns, these calls become more frequent as...

RRSP or TFSA

RRSPs and TFSAs are both “registered” investment accounts, which means that they receive special tax treatment that is not applicable to other “non-registered” investment accounts. The special tax treatment of these accounts increases the total benefit of investing by...

Month of Giving (Part 3): Donation of Securities

Instead of liquidating securities to fund donations, it may be more tax efficient to donate securities directly to charitable organizations. If you sell a security to obtain cash to donate, you generally need to pay tax on the profit earned, also known as a capital...

Month of Giving (Part 2): Tax Efficient Donating

Many physicians in Canada have incorporated their practices, as there are significant tax benefits to doing so. This then provides incorporated doctors with two avenues to donation: Corporate Donations Personal Donations We are often asked, “should I make donations...

Month of Giving (Part 1): Donation Tax Credit Refresher

December is the month of giving. While deciding which charitable organizations you wish to support this year, the following donation tax credit information is good to keep in mind: What qualifies as a donation for tax purposes? To qualify for the donation tax...

The Season of Giving – is it taxable?

As the holiday season approaches, it is not unusual for doctors to provide gifts to their employees, hospital administrative staff, colleagues, and nurses. While these gifts are generous gestures, they may result in unexpected tax implications. Gifts to Employees When...

Financial Considerations of Buying a Home

There is a lot to think about when you buy your first home. What colour should you paint the living room? What should the extra bedroom be used for? A home office? A gym? Or maybe a nursery? Outside of aspirational objectives, there are many practical matters...