As veterans of higher education, physicians often anticipate that their children will carry the torch of...

Basic Overview of Canadian Personal Taxes

You May Also Like…

Personal tax season is upon us and as you gather your personal tax documents you may be wondering “How are my personal taxes calculated?”.

How are Canadian Personal Taxes Calculated?

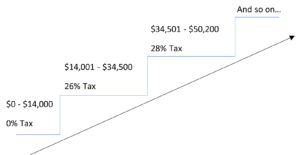

Canadian taxes are based on a graduated rate system.

This system can be thought of in terms of steps, commonly called “tax brackets”. Each bracket represents a range of income that is subject to a specific tax rate. A tax rate is a percentage upon which an individual is taxed.

Income earned within each bracket is taxed at the applicable rate.

The below graphic depicts a simplified version of how this works:

Exhibit A

*Rates and brackets used above are loosely based on the combined Manitoba and Federal personal tax rates, considering the basic personal tax credit, and are not comprehensive. Used for illustrative purposes only.

**Tax rates change annually. The above is based on 2022 tax rates.

Personal taxes are comprised of two parts: federal taxes and provincial taxes.

The federal tax brackets remain the same for every individual, regardless of where they live and work within Canada. The provincial tax brackets vary by province and territory but are still applied using the same graduated rate system.

Exhibit A is based on the combined Manitoba and federal personal tax rates.

Using the above figures, if you earned $40,000 in 2022, your personal tax would be calculated as follows:

$14,000 x 0% = $0

$20,500 ($34,500 – $14,000) x 26% = $5,330

$5,500 ($40,000 – $34,500) x 28% = $1,540

Total tax = $6,870 ($0 + $5,330 + $1,540)

If you had multiple sources of income, the total income received from all sources would be combined and your personal taxes for the year would be calculated based on the total.

Calculating your Taxable Income as a Self-Employed Physician:

If you earn fee-for-service or stipend income (self-employment income), your personal taxes are calculated on your self-employment income less any reasonable business expenses.

Business expenses are considered reasonable if the expense was incurred to earn the fee-for-service income and the costs were not extravagant (for example, CRA would likely not allow a $10,000 hotel expense for a 2-day conference in Banff).

Common examples of reasonable business expenses incurred by self-employed physicians include, but are not limited to:

- CMPA

- Professional dues and memberships – Doctors Manitoba dues, CPSM dues, etc.

- CME costs – This includes registration fees and travel and accommodations if you needed to travel to attend the conference or course.

- Cell phone and internet

If you received a reimbursement for any business expense, the reimbursed portion cannot be claimed. For example, the claim for CMPA insurance or CME should be reduced by any reimbursement received from entities such as Doctors Manitoba.

Calculating your Taxable Income as a Resident Physician:

Resident physicians often have a single main source of income: their wages from the health region in which they work.

As a resident physician, you can expect to receive a T4 slip around February or March that reports the amount of gross wages you received during the prior year.

The gross wages reported on this slip would then be used to calculate your personal income taxes for the year.

If you had also earned fee-for-service income (self-employment income), your personal taxes would be calculated based on the combined total of your gross wages and your self-employment income.

If you received a reimbursement for any of the expenses, the expenses cannot be claimed. So, for example, often the Doctors Manitoba dues are paid for by Shared Health for residents, this is included on your T4 slip and cannot also be claimed against your fee-for-service income. In addition, residents generally only pay for a certain percentage of their annual CMPA fees, and the remainder is covered by PARIM. The claim for the CMPA fees would be limited to the percentage that the resident had to pay.

Can you claim any amounts to reduce your personal taxes?

Yes, in Canada there are several items that can be used to reduce personal taxes, whether you are employed or self-employed.

The following are some of the items that may be claimable on your personal tax return:

- Childcare

- Post-Secondary Tuition

- Donations

- Medical Expenses

- Interest on National or Provincial Student Loans (you cannot claim interest on a Student Line of Credit)

- Contributions made to a Registered Retirement Savings Plan (RRSP)

Receipts for the above items should be kept and provided to your tax preparer each year.

If you are unsure if an item can be claimed on your personal tax return, it is always a good idea to consult a tax professional.

* This article was prepared on February 16, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

You May Also Like…

Fall Economic Update 2022 – A 5 Minute Summary of the Relevant Provisions for Physicians

Overall Analysis: New details were scarce in the 2022 Fall Economic Statement; for the most part, the Honorable Chrystia Freeland provided more detail on the 2022 Budget Proposals. In summary, the provisions most relevant for physicians were as follows: PROPOSAL:...

Moving Expenses: When are they deductible for physicians?

Are you a physician who moved in 2022, or are considering a move in 2023? If so, your moving expenses may be deductible for tax purposes. Are you eligible to claim moving expenses? To claim moving expenses, you must meet the following criteria outlined by CRA: One...

First Home Savings Account (FHSA) – Newly Announced Updates to the Program

This article has been updated for the draft legislation proposals from the Department of Finance ‘Design of the Tax-Free First Home Savings Account’ Backgrounder, released August 9, 2022.. On April 7, 2022, the Federal Government released a budget with two new...

The Self-Employed Physician

How to Organize Yourself for Personal Tax Filing Step 1: Be Aware of Your Income & Expenses As a self-employed physician, fee-for-service income can come from a variety of sources, including various health authorities (WRHA, NRHA, IERHA, etc.),...

4 Common Tax Questions from Manitoba Resident Physicians

The most frequent questions we receive from resident physicians relate to their ability to claim various tax credits and deductions. This is often complicated by their participation in various assistance or rebate programs and the continuing cost of their medical...