Feb 17, 2023

Are you a physician that moved to Canada in the last year? If so, these are some things that you should know about filing your first Canadian Personal Tax Return:

When are Canadian taxes due?

Canadian personal taxes are calculated based on income earned between January 1st and December 31st each year.

Your personal tax return must be filed with the Canada Revenue Agency (CRA) by:

- April 30th of the following year, if you are not self-employed.

For example, if you were a resident physician in 2022 and only had employment income, your 2022 personal tax return must be filed by April 30, 2023.

- June 15th of the following year, if you are self-employed.

For example, if you earned fee-for-service income in 2022, your 2022 personal tax return must be filed by June 15, 2023.

If you owe taxes, you must pay the tax balance by April 30th of the following year regardless of your filing deadline.

As a result, even if you did earn self-employment income in 2022 and have the June 15, 2023 filing deadline, it is best to start preparing your personal tax return well before April 30, 2023. This will ensure that if you have a tax balance owing to the CRA, you have ample time to make the payment before April 30th.

How are Canadian Personal Taxes Calculated?

Income Earned Before Becoming a Canadian Resident:

Any income earned prior to your move to Canada would not be taxable on your first Canadian personal tax return. However, you must still report this amount to the CRA.

The amount of income that you earned between January 1st and the date that you entered Canada is used to calculate certain personal tax credits, so your accountant will ask you to provide them with the amount of income that you earned prior to living in Canada as well as the income that you earned from the date that entered Canada.

Income Earned After Becoming a Canadian Resident:

Your Canadian personal taxes will be calculated based on your world-wide income from the date that you became a Canadian Resident.

For example, if you moved to Canada during 2022 but continued to earn income in your previous country of residence after your move to Canada, the income would be taxed on your 2022 Canadian personal tax return.

Canadian personal taxes are calculated on a graduated scale. The calculation is explained in detail in our Basic Overview of Canadian Personal Taxes – Bokhaut CPA Inc article.

Other Things to Consider:

Foreign Property:

If you hold “property” in another country with a total cost* of more than $100,000 CAD, you will need to file an annual Foreign Income Verification Statement.

“Property” includes, but is not limited to:

- Cash

- Investments

- Rental properties

- Vacant land

- Life insurance policies

The Foreign Income Verification Statement does not result in any additional taxes, however if the statement is not filed on time, it can result in significant penalties.

For your first year in Canada, you are exempt from filing this form. However, any income earned from these properties in the tax year will need to be reported on your Canadian personal tax return if it was earned after the date that you entered Canada.

*The “cost” of the property would be calculated as the Fair Market Value of the property at the date that you came to Canada (converted into Canadian dollars at that same date).

Moving Costs:

In Canada you are allowed to claim moving expenses if you moved at least 40kms closer to your place of work.

Unfortunately, the move from another country to Canada, generally does not qualify for this moving expense deduction as those moving expenses are a cost of immigration.

There are a lot of things to consider when filing your first Canadian personal tax return, as a result we highly recommend that you consult a tax professional.

* This article was prepared on February 16, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

Feb 17, 2023

Personal tax season is upon us and as you gather your personal tax documents you may be wondering “How are my personal taxes calculated?”.

How are Canadian Personal Taxes Calculated?

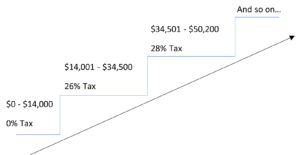

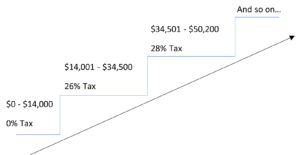

Canadian taxes are based on a graduated rate system.

This system can be thought of in terms of steps, commonly called “tax brackets”. Each bracket represents a range of income that is subject to a specific tax rate. A tax rate is a percentage upon which an individual is taxed.

Income earned within each bracket is taxed at the applicable rate.

The below graphic depicts a simplified version of how this works:

Exhibit A

*Rates and brackets used above are loosely based on the combined Manitoba and Federal personal tax rates, considering the basic personal tax credit, and are not comprehensive. Used for illustrative purposes only.

**Tax rates change annually. The above is based on 2022 tax rates.

Personal taxes are comprised of two parts: federal taxes and provincial taxes.

The federal tax brackets remain the same for every individual, regardless of where they live and work within Canada. The provincial tax brackets vary by province and territory but are still applied using the same graduated rate system.

Exhibit A is based on the combined Manitoba and federal personal tax rates.

Using the above figures, if you earned $40,000 in 2022, your personal tax would be calculated as follows:

$14,000 x 0% = $0

$20,500 ($34,500 – $14,000) x 26% = $5,330

$5,500 ($40,000 – $34,500) x 28% = $1,540

Total tax = $6,870 ($0 + $5,330 + $1,540)

If you had multiple sources of income, the total income received from all sources would be combined and your personal taxes for the year would be calculated based on the total.

Calculating your Taxable Income as a Self-Employed Physician:

If you earn fee-for-service or stipend income (self-employment income), your personal taxes are calculated on your self-employment income less any reasonable business expenses.

Business expenses are considered reasonable if the expense was incurred to earn the fee-for-service income and the costs were not extravagant (for example, CRA would likely not allow a $10,000 hotel expense for a 2-day conference in Banff).

Common examples of reasonable business expenses incurred by self-employed physicians include, but are not limited to:

- CMPA

- Professional dues and memberships – Doctors Manitoba dues, CPSM dues, etc.

- CME costs – This includes registration fees and travel and accommodations if you needed to travel to attend the conference or course.

- Cell phone and internet

If you received a reimbursement for any business expense, the reimbursed portion cannot be claimed. For example, the claim for CMPA insurance or CME should be reduced by any reimbursement received from entities such as Doctors Manitoba.

Calculating your Taxable Income as a Resident Physician:

Resident physicians often have a single main source of income: their wages from the health region in which they work.

As a resident physician, you can expect to receive a T4 slip around February or March that reports the amount of gross wages you received during the prior year.

The gross wages reported on this slip would then be used to calculate your personal income taxes for the year.

If you had also earned fee-for-service income (self-employment income), your personal taxes would be calculated based on the combined total of your gross wages and your self-employment income.

If you received a reimbursement for any of the expenses, the expenses cannot be claimed. So, for example, often the Doctors Manitoba dues are paid for by Shared Health for residents, this is included on your T4 slip and cannot also be claimed against your fee-for-service income. In addition, residents generally only pay for a certain percentage of their annual CMPA fees, and the remainder is covered by PARIM. The claim for the CMPA fees would be limited to the percentage that the resident had to pay.

Can you claim any amounts to reduce your personal taxes?

Yes, in Canada there are several items that can be used to reduce personal taxes, whether you are employed or self-employed.

The following are some of the items that may be claimable on your personal tax return:

- Childcare

- Post-Secondary Tuition

- Donations

- Medical Expenses

- Interest on National or Provincial Student Loans (you cannot claim interest on a Student Line of Credit)

- Contributions made to a Registered Retirement Savings Plan (RRSP)

Receipts for the above items should be kept and provided to your tax preparer each year.

If you are unsure if an item can be claimed on your personal tax return, it is always a good idea to consult a tax professional.

* This article was prepared on February 16, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

Jan 27, 2023

How to determine if it’s CRA on the line.

Over the past few years, scam phone calls from individuals claiming to be from the Canada Revenue Agency (CRA) have increased. As we approach the time of year to file personal tax returns, these calls become more frequent as scammers seek to take advantage of the tax season.

These scam callers can seem quite legitimate and often use intimidation to gather information.

If you think the call may be a scam, the best option is to hang up and contact CRA directly on their main personal or business lines. An agent at CRA should be able to review your file and confirm if the call was legitimate.

Real CRA agents have policies and scripts which they are required to follow. If the call you receive deviates from the below, you may have been contacted by a scammer:

- A CRA agent will always identify themselves by name.

- The CRA will never “confirm your identity” with information that is not available on your personal tax return (ex. a credit card number).

- The CRA will never issue threats of arrest or sending law enforcement. Most scam callers will become angry or argumentative if questioned.

- The CRA will never request payment of taxes in the form of gift cards, cryptocurrency, or any other unusual form of payment.

- The CRA will never contact you to recommend or assist in applying for benefits.

If you are unsure about the caller, ask and make note of the following information:

- Name

- Agent ID

- Phone Number

- Office Location

If the caller refuses to or cannot provide this information, it is very likely a scam.

The CRA phone numbers are:

Personal – 1-800-959-8281

Business – 1-800-959-5525

For more information on reasons CRA may contact you and how to report a potential scam, please follow the link below:

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2022/not-sure-cra-calling-here-how-to-find-out.html

* This article was prepared on January 27, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

Jan 18, 2023

RRSPs and TFSAs are both “registered” investment accounts, which means that they receive special tax treatment that is not applicable to other “non-registered” investment accounts.

The special tax treatment of these accounts increases the total benefit of investing by minimizing taxes.

While both accounts are “registered”, they have different tax attributes. Understanding these attributes can help you to determine which account is more beneficial to you based on your circumstances, and in which account to prioritize investing.

Tax Attribute Summary:

Contributions

RRSP: “Pre-tax” Dollars

RRSP contributions can be deducted on your tax return to reduce your taxable income. This means that they are not taxed when you make the contribution but are taxed when you withdraw the funds from your RRSP in the future (likely in retirement).

TFSA: “After-tax” Dollars

TFSA contributions are made with funds that have already had the tax deducted. These contributions do not reduce your taxable income.

Annual Investment Income

There is no tax levied on the annual investment income earned in an RRSP or TFSA.

Withdrawal

RRSPs are taxable to you in the year you withdraw the funds (as you received a tax deduction when you contributed them). Once you withdraw funds, that contribution room does not get reinstated.

TFSAs are not taxable to you in the year you withdraw the funds (you were taxed before you made the contribution). Withdrawals from the TFSA are reinstated as available TFSA room in the following year.

Which account is the most tax efficient to contribute to?

RRSPs

RRSPs typically provide more tax savings to individuals in a higher tax bracket, as the deduction reduces taxable income.

For example:

If a physician in the highest tax bracket (~50%), makes an RRSP contribution of $10,000, their tax liability would be reduced by $5,000 ($10,000 deduction * 50% tax rate).

If a resident physician that was taxed at ~35% made the same contribution, their tax reduction would be only $3,500 ($10,000 deduction * 35% tax rate).

In this case, the attending physician saves $1,500 more in tax than the resident physician based on the same contribution amount.

Resident physicians typically begin their careers in a lower tax bracket and advance to high tax brackets when they become attendings.

It can be beneficial for resident physicians to defer the use of their RRSP contribution room (and therefore, deduction) until a future year when they become attending physicians and have higher income.

“Saving your deduction”

Though typically not feasible, an alternative means for residents to receive the higher tax savings is to make the RRSP contributions now and save the deduction for a future tax year to use against higher rate income. This strategy can result in cash flow issues in the year(s) of contribution, as the doctor is still taxed on their total income despite making an RRSP contribution and losing access to those funds.

RRSP Related Programs

Beyond tax savings, there are other programs that are associated with RRSPs which may make contributions in lower tax years beneficial. The two programs that are facilitated through the RRSP are:

This program allows the borrowing of up to $35,000 from your RRSP account(s) on a tax-free basis with a 15-year repayment period.

Please visit https://bokhaut.ca/fhsaupdates/ for more information on this program’s eligibility requirements and tax implications.

- Lifelong Learning Plan (LLP)

This program allows for loans of up to $20,000 for the funding of qualifying full-time education programs for taxpayers or their spouses and can be utilized multiple times.

Please visit https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4112/lifelong-learning-plan.html for more information.

TFSA

As noted above, TFSA contributions are made with “after tax” funds. These contributions don’t entitle taxpayers to a tax deduction, so they must pay tax on the income used to make the contribution.

However, individuals do not pay tax on any income earned within the TFSA (interest, dividends, etc.) or on withdrawals from the account.

This typically provides the most tax benefit to individuals who are in low tax brackets now and expect to be in higher tax brackets in the future.

For example:

A physician in the highest tax bracket (~50% in Manitoba) would have to earn ~$13,000 and pay tax of ~$6,500 to have enough after-tax funds to make a TFSA contribution of $6,500 ($13,000 income – $6,500 tax).

A resident physician taxed at ~35% would only have to earn ~$10,000 and pay tax of ~$3,500 to have enough after-tax funds to make a TFSA contribution of $6,500 ($10,000 income – $3,500 tax).

In addition to tax-free withdrawals from the account, any amounts withdrawn each year are added back to the taxpayer’s TFSA contribution room in the year following the withdrawal. For example, if an individual withdraws $10,000 from their TFSA in 2023, $10,000 plus the regular annual limit will be added to their contribution room in 2024.

In conclusion:

Apart from use of the HBP or LLP programs, TFSAs are better suited for short term savings, as the funds can be more flexibly withdrawn and recontributed. They are also more beneficial to individuals in a lower tax bracket.

RRSPs are more advantageous to doctors with higher income, as the deductions reduce taxable income at high tax rates. Further, contributions are made “pre-tax”, allowing you to contribute more principal to compound over time. This is best when the funds are not needed and can be set aside for many years.

If you are a physician and have questions on the above, please contact us.

* This article was prepared on January 10, 2023. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.

Dec 21, 2022

Instead of liquidating securities to fund donations, it may be more tax efficient to donate securities directly to charitable organizations.

If you sell a security to obtain cash to donate, you generally need to pay tax on the profit earned, also known as a capital gain.

When a security is disposed of for proceeds greater than its original cost , a capital gain is ‘realized’. The capital gain is calculated as the proceeds received on the disposition less the cost it was acquired at.

Typically, there is capital gains tax levied against 50% of the realized gain.

However, gains realized on the donation of securities are exempt from tax, regardless of whether the securities are donated using corporate funds or personal funds.

Therefore, if you donate a security, you do not need to pay tax on the unrealized capital gains when you dispose of it.

*The donation of securities has beneficial tax treatment only to the extent that the securities have unrealized gains.

Summary of Benefits:

No personal or corporate tax on the unrealized gain.

When you donate securities with unrealized capital gains to an organization, you do not need to pay tax on unrealized gains prior to making the donation. This means you can give the entire value of the security to the charity without of giving a portion to Canada Revenue Agency first.

No tax levied on the charity for the unrealized gain.

Charities are generally tax exempt. As a result, the unrealized gain is never taxed, and the charity gets the full benefit of the entire fair market value of the security.

100% of gain added to the Capital Dividend Account.

When you donate directly from a corporation, the capital gain contributes twice as much to the Capital Dividend Account (described in more depth below), allowing for the extraction of double the amount of tax-free dividends from the corporation.

Donation of Securities from Personal Funds (Top Personal Tax Bracket)

|

Donate Shares Directly |

Sell Shares & Donate Cash |

| Proceeds (Value of Donated Securities) A |

$10,000 |

$10,000 |

| Cost |

$2,000 |

$2,000 |

| Gain (Proceeds – Cost) |

$8,000 |

$8,000 |

| Taxable Gain (Gain * 50%) |

Nil |

$4,000 |

| Capital Gain Tax (Taxable Gain * 50.4%) B |

Nil |

$2,016 |

| After Tax Funds Available to Donate (A-B) |

$10,000 |

$7,984 |

*50.4% is the highest tax rate in MB.

|

Securities |

Cash |

| Donation |

$10,000 |

$7,984 |

| Tax Savings (From Donation Tax Credit) |

(4,991) |

(3,975) |

| Total Effective Cost of Donation |

$5,009 |

$6,025 |

| Benefit to donating Securities instead of Cash ($6,025 – $5,009) |

$1,016 |

As shown above, donating securities directly can increase tax savings and reduce the overall cost of the donations.

Donation of Securities from Corporate Funds

Donating securities that have unrealized gains from a medical corporation can have additional advantages.

The medical corporation has a tax account called the ‘Capital Dividend Account’ or ‘CDA’. The non-taxable portion of gains are added to the value of the CDA. A positive CDA balance can be paid out as a tax-free capital dividend to shareholders.

Usually, 50% of a capital gain is taxable and the remaining non-taxable portion, also 50%, is added to the CDA.

When you donate securities with unrealized gains, none of the gain is taxable, and therefore, the entire gain is the non-taxable portion. This amount is all added to the CDA, which allows you to take out twice the amount of tax-free dividend.

|

Donate Shares Directly |

Sell Shares & Donate Cash |

| Proceeds (Value of Donated Securities) |

$10,000 |

$10,000 |

| Cost |

$2,000 |

$2,000 |

| Gain (Proceeds – Cost) |

$8,000 |

$8,000 |

| Taxable Gain |

0% |

50% |

| Added to CDA

(Non-Taxable Portion of Gain) |

$8,000 |

$4,000 |

Under this scenario, no corporate tax would be payable on the direct donation of the shares to the charity and an additional $4,000 would be added to the CDA balance to be withdrawn tax-free in the future.

Physicians are often in the highest tax bracket, so an additional $4,000 of tax-free money would save ~$4,000 in tax, if the amount would otherwise be drawn out as salary.

*To receive $4,000 of net pay from the corporation, a gross salary of ~$8,000 would be required, and $4,000 would be paid to Canada Revenue Agency.

In sum, the total tax savings from donation of securities instead of cash is as follows:

| Tax Savings from donating Securities instead of Cash |

$1,016 |

| Tax Savings from additional CDA (Tax Free-Dividends) |

$4,000 |

| Total Tax Savings |

$5,016 |

If you would like a consultation regarding tax for physicians, please contact us.

* This article was prepared on December 21, 2022. Content is for informational purposes only and is not intended to be used as professional advice. Each taxpayer’s circumstances are unique. Bokhaut CPA makes no representation as to the accuracy and completeness of the information in this article and will not be liable for any errors or omissions in this information.